Leanvoicing: online invoicing for lean startups

Leanvoicing is a powerful, flexible online invoicing solution for startups and solopreneurs. The name comes from "lean

" (as in lean startup) and "invoicing

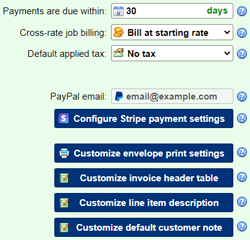

." Affordable, it accommodates typical and less common billing scenarios like pre-tax and post-tax fees, variable taxability of products and services, etc. Leanvoicing also supports receiving online payments using providers like PayPal or Stripe.

Automated and one-click invoices

With one click of your mouse or one tap of your finger, you can generate an invoice for all unbilled work. You can also individually customize invoices. Your billing needs and how you streamline them determine the time you'll spend invoicing. Ideally, this should be close to zero minutes. Leanvoicing is designed for one-click invoicing. Set it up, and never spend time on it afterward. ![]()

Custom billing settings

Leanvoicing is all about flexibility.

Leanvoicing is all about flexibility.

You can customize nearly every aspect of your customers' billing experience, from rates and line-item breakup to taxes and online payment options. For clients who prefer receiving their bills by snail mail, Leanvoicing even supports printing your invoices, and they're laid out to accommodate popular envelope formats.

Plans and rates

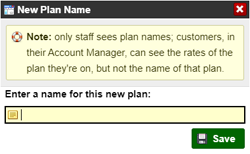

Each customer is assigned to a rate plan. By default, they're assigned to the "

Each customer is assigned to a rate plan. By default, they're assigned to the "Default

" plan. Each plan contains one or more rates. Customers can only see rates in their own plan. This lets you offer lower rates for non-profit organizations, for example. Each rate can be billed "as is" or customized (explained below).

Rate modifiers

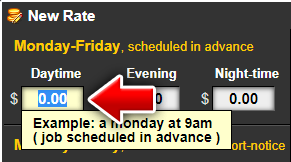

You can charge all clients the same rate, regardless of date / time / holiday status, etc. But this approach leaves money on the table. Leanvoicing includes up to 27 rate combinations. In addition, for each service you offer, you can have up to three time-of-day rates: Daytime, Evening, and Night-time. (And of course, you get to choose the start- and end-times for each of these periods.)

Besides time of day, you can also have (again, optionally) a different set of rates whether you provide the service on a weekday, a weekday, or on a holiday. (You can choose which dates you bill at your holiday rate - see further down.)

The final set of rate modifiers let you select whether a job was scheduled in advance, with short notice, or as emergency / at the last minute. You get to decide what each of those mean based on your industry or personal preference. Example: you can ask that people commission your services with at least 48-hour notice. You'd consider 24 hours as a "short notice" request. Anything shorter, assuming you even accept the job, would qualify as an emergency / last-minute request. The key is that you decide what each of those are.

Invoice rate-splitting by time of day

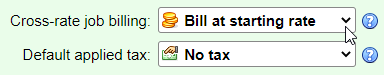

Imagine that you offer services whose rate depends on the time of day, like interpreting services or consulting. If your session runs across two rates, no problem. Leanvoicing lets you decide whether to bill the entire session at the starting rate or to split the session into two different rates:

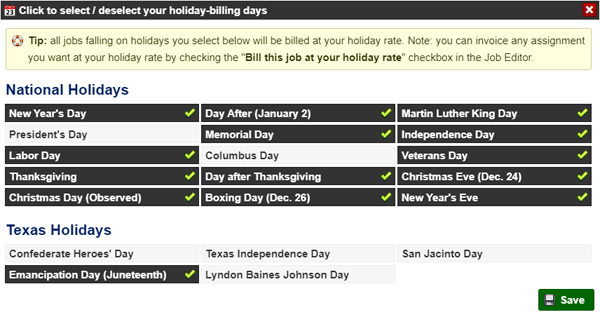

Holiday billing

You can pick custom rates for federal / state / bank holidays. You can choose which federal / state holidays have holiday billing. You can even mark specific jobs as being billed at your holiday rate (regardless of when they take place.) Here are the options for a Texas-based business:

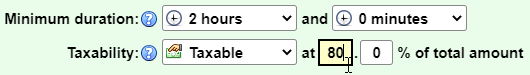

Taxes

Leanvoicing supports VAT and sales taxes. Assuming that you charge taxes, you pick which rates / fees / discounts are taxable. Maybe unlike any invoicing solution you've tried, Leanvoicing even lets you customize how much of a rate is taxable. In Texas, for example, only 80% of the amount billed for "data processing fees

" is taxable. Leanvoicing accommodates those edge cases with flair:

Each fee and discount can be created as pre-tax (applied before sales taxes are calculated) or post-tax (added after taxes have been applied to the invoice).

Financial reports

Invoicing your clients is just the first step. To help you keep up with the financial health of your business, Leanvoicing includes three one-click reports from the invoice screen: Unpaid Invoices, Recently Paid Invoices, and Past-due Invoices. ![]()

For more detailed information, you can head over to the Reports section of the app, where you'll find reports you can run for month, quarter, year, or "year-to-date" periods of time: A/R Report, Cash-receipts report, and Aging report.

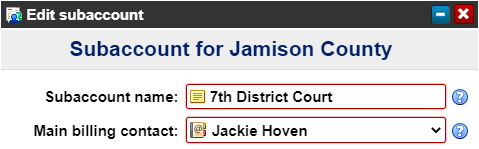

Clients: organizations and subaccounts

Leanvoicing stores billing contacts, each of which belongs to an organization. For billing purposes, an organization can have subaccounts (divisions in a company, departments in a university, etc.) They're separate entities but often share contacts (e.g., staff accountants) and might even be billed at the same rate. Subaccounts let you efficiently manage large customers without duplication.

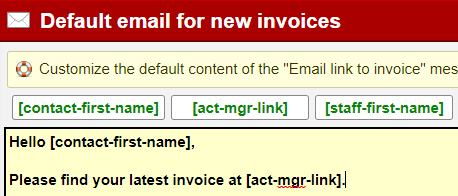

Automated email notifications

To save time, you can create email templates for various scenarios, like sending an invoice for the first time, sending reminders for past-due invoices, etc.

Leanvoicing is there to make your life easier. No one gets in business to write invoices; invoicing is just the necessary process that keeps you in business.